Welcome to Forest Road, E17! Located in the heart of Walthamstow, it features 90 one-bedroom Pocket homes, including adaptable options for wheelchair users and private terraces. These affordable homes in London offer the perfect blend of urban living, accessibility, and community.

In this blog, we’re showing you what Forest Road is all about and what exactly makes these homes so affordable… Architectural innovation, eco-friendly design, community spirit, and Walthamstow’s art and culture are just a step away.

Affordability

We believe that everyone deserves the opportunity to own a home in the city they love, which is why Pocket offer 100% owned homes, available to eligible first time buyers for at least 20% less than the market value. Through innovative design, cost-effective construction, and government-backed initiatives, we’re making homeownership in London a reality for first time buyers. Forest Road is one of many of our schemes creating affordable homes in London, keep reading to learn more!

Location

Located in Walthamstow, ‘Britain’s coolest neighbourhood’, Forest Road offers culture, food to die for, and endless entertainment. Here’s why this location is perfect for modern urban living:

- Hoe Street: Hoe street is located between the east and west of Walthamstow, and is pretty much the best of both worlds. You’ll find 5 star restaurants hidden between a greasy spoon and a yoga studio. So, whatever you’re in the mood for, you’ll find it here.

- Commuters Paradise: With transport links surrounding you, you can take your pick between bus, train and your own two feet! Walthamstow central is a mere 12 minute walk away, and you can hop on the tube to Kings Cross in just 14 minutes.

- Walthamstow Village: The oldest part of Walthamstow, Waltham village, is a Conservation Area on Orford Road. Take a stroll through the part of the neighbour hood and discover popular spots like Eat17 and The Ancient House.

- Green Space: City maker or not, everyone needs a bit of fresh air. With beautiful green spaces like Lloyd Park and Walthamstow Wetlands just around the corner, morning walks and picnics in the park have never been easier.

Home Features

We carefully designed these Pocket homes to match the lifestyles of modern city makers. Here’s what to expect in these affordable homes in London:

- Open-Plan Living: The open-plan living space not only makes your home feel more spacious, but also makes hosting that bit more enjoyable. Now you can strike up conversation with your guests whilst cooking up a storm!

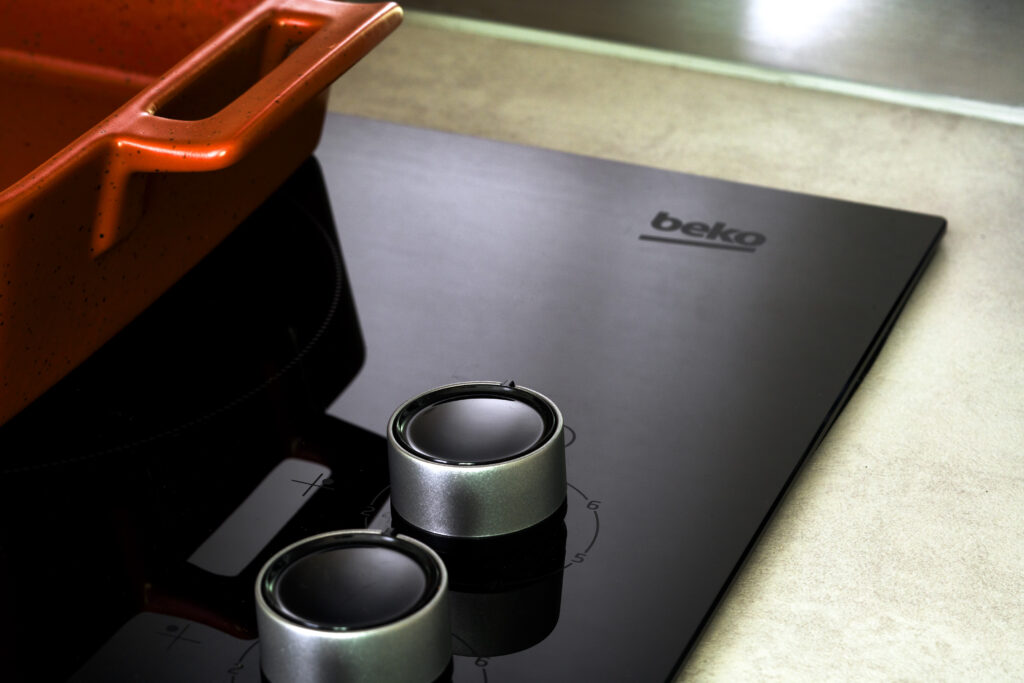

- Fully-Equipped Kitchen: Your sleek and modern kitchen includes a slimline laminate worktop, granite composite sink, built-in Beko appliances, a ceramic hob with stainless steel splashback, and more. Whether you spend hours in the kitchen, or prefer a takeaway, we’ve got you covered.

- Stylish Wet Room: The bathroom is not only aesthetic, but also practical. It features a modern wet room with a walk-in shower and large-format tiles. Ideal Standard ceramics and a Corian vanity top add that touch of luxury.

- Bedroom Comfort: The bedroom offers plenty of space for a double bed, bedside cabinets, and a wardrobe.

- Energy Efficiency: Featuring highly insulated interiors, energy-efficient lighting, solar panels, and air source heat pumps, these homes reduce energy costs and minimise environmental impact.

Amenities

From evenings on the rooftop with friends, to growing veg in the allotment beds, Forest Road was designed to create a community. Here are some amenities in these affordable homes in London, to keep your everyday life interesting:

- Community Rooftop Terraces: These affordable homes in London feature two communal rooftop terraces with views of Lloyd Park and beyond. These spaces are perfect for relaxing, evening drinks, or exercising.

- South-Facing Courtyard Garden: The ground-level courtyard garden is the perfect place to connect with your neighbours. This south-facing garden has a variety of comfortable seating options and even some communal allotment planters for those green thumbs!

- Spacious foyer: The entrance at Forest Road is a large and airy space intended to encourage residents to linger and converse whilst collecting post or heading in for the night.

- Secure Bicycle Storage: In an eco-conscious age, we’re actively encouraging cycling. So whether you commute daily or simply enjoy a summers bike ride, you’ll know that your bike is protected in our secure bike storage.

Sustainability

- Highly Insulated Homes: These affordable homes in London are highly insulated, meaning they efficiently retain heat. Not only will this keep you comfortable in those grisly winter months, it’ll also reduce your monthly energy costs.

- Solar Power: Solar panels contribute to the electricity supply for communal areas which is a step towards cleaner, renewable energy sources.

- Natural Light: Floor-to-ceiling windows throughout the development allow natural daylight to brighten up your living space and minimise the need for artificial lighting.

- Air Source Heat Pumps: This scheme utilises air source heat pumps to provide renewable heating and hot water. This technology reduces our carbon footprint whilst making certain you’ll be comfortable.

- Brownfield Site Development: The homes are constructed on an urban brownfield site. By reusing existing sites, we’re helping to protect London’s Green Belt and reducing new construction on untouched land.

Floor Plans and Pricing

These affordable homes in London start from just £298,000! To view the full price list, click here.

To view the brochure & floorplans, click here.

Visit pocketliving.com and get started on your homeownership journey today. By creating your My Pocket account, you can explore the range of 20% discount, 100% ownership homes tailored for you.